John Cleese and Terry Jones (Mr Creosote) in Monty Python’s The Meaning of Life Photo: Film Still

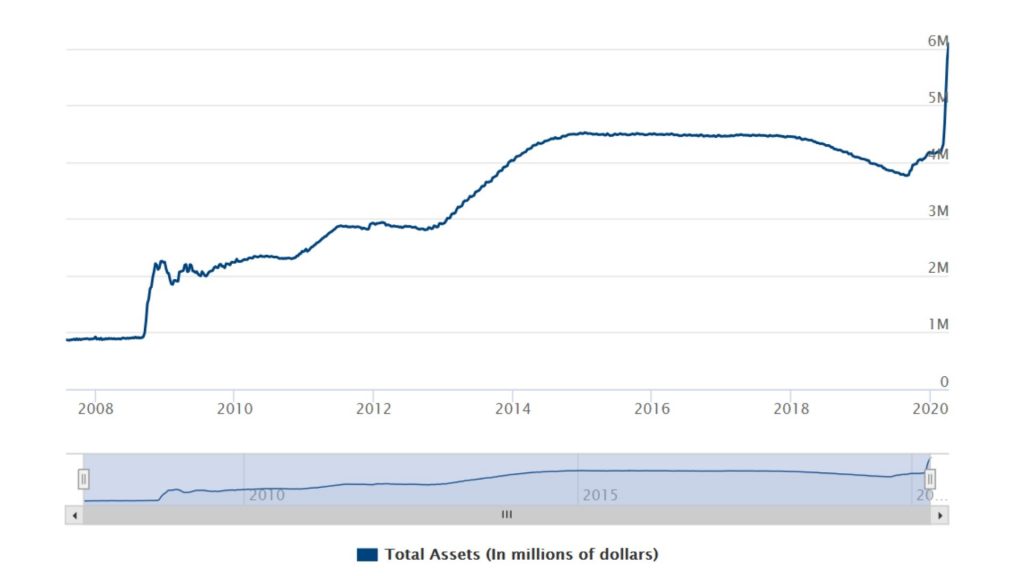

As the Federal Reserve’s balance sheet balloons to all time highs from backstopping all commercial loans, purchasing ETFs and funding UBI checks, we are approaching a Monty Python moment of excess whereby the intervention by the USA’s central bank might begin to bloat to such extremes that they become untenable to hold.

In a speech last Thursday Fed Chair Jerome Powell outlined how “we have acted to safeguard financial markets in order to provide stability to the financial system and support the flow of credit in the economy. As a result of the economic dislocations caused by the virus, some essential financial markets had begun to sink into dysfunction, and many channels that households, businesses, and state and local governments rely on for credit had simply stopped working. We acted forcefully to get our markets working again, and, as a result, market conditions have generally improved.”

Although the intervention began late last month, these words were further music to the ears of leading hedge funds such as Renaissance Technologies, Bridgewater and Citadel.

Before the central bank intervention, Renaissance Technologies suffered a 17% drawdown and only Bridewater ‘s options bet cushioned the blow. Although Citadel’s flagship fund has actually turned a profit for 2020.

According to CNBC, on 6th of February, Griffin of Citadel called the coronavirus “probably the most concrete short-run risk we see in the financial markets globally” during an appearance at The Economic Club of New York.

Stock markets around the world began their plummet on the 21st of February. Their drop was arrested by the Fed’s intervention on the 3rd of March, leading to a viral image of mass unemployment but the best market performance in decades.

Everything that is wrong with America, in one image. pic.twitter.com/ugrft95bAv

— Justin (@JustinAHorwitz) April 9, 2020

Once things get back to normal however, the Fed is most likely going to have to withdraw support from some segments of the market before a Wafer Thin Mint blows away the saving power of the Dollar. And normal may not look so far away.

The country most watched is China, where COVID-19 first appeared and lockdowns were trialled. As China’s economic statistics have long been questioned, many quant strategies typically include ‘alternative data’ in their algorithms. iPhone shipments are having a resurgence in China for instance, leaving open the possibility that a new normal may be close.

Read: Welcome to the Financial Mirror of Alternative Data

But the Fed’s balance sheet increase is most likely to lead to inflation. One of the worst places an economy can find itself in is ‘stagflation’, where slow grow is coupled with rising prices.

Federal Reserve Monetary Policy: pic.twitter.com/tUDqEz0gyz

— Steve Burns (@SJosephBurns) April 9, 2020

As ever, the news is flowing thick and fast in 2020.

One fintech that has taken off as financiers try to stay on top of the market news remotely is Atom Finance. The startup aims to give users a ‘Bloomberg Terminal feel’ ($24,000 per year) for free. Now, traders can get the cutting edge tools for free as well as brokers providing 0% commission trading. DisruptionBanking likes the feel of it.

We are officially live with Atom+, our premium news and content offering. If you haven’t already received an invite, join our waitlist at https://t.co/Y4vDYE0hny. https://t.co/1KiH651qrU

— Atom Finance (@atom_finance) March 4, 2020

Charlie Shrem’s podcast on bank crises might be quite useful to listeners trying to ascertain what a bank meltup might look like once the Fed withdraws support and exclaims “I couldn’t eat anything more I’m absolutely stuffed.”

Here’s an Untold Story for you….

Want to know what a bank meltdown looks like? @BtcDanny was in business in Cyprus in 2013 when a banking crisis hit and his crypto bank Neo & Bee fell apart.

Listen now

🎧https://t.co/uhOvDfQA7p

🎧https://t.co/4GOOXQIbZoThanks @Bitpay pic.twitter.com/ahQStDJB9a

— Charlie Shrem (@CharlieShrem) April 14, 2020

Do we dare to question if the Fed is digital-ready?

Until #coronavirus, this was my typical way of dealing with a bank’s internal presentation team pic.twitter.com/adTdSpGmlP

— Chris Skinner (@Chris_Skinner) April 14, 2020

Looking to learn how to code for free? Check out HTML.net to learn PHP, CSS, JavaScript and HTML.

Looking to make a difference in someone else’s life or ask for a donation? Check out Leveler.info for wealth redistribution.

Just woke up from a really long nap and suddenly wondered what happened to the world? Click on this link to flatten the curve.

Looking for tips to stay physically healthy? Check out this link.

Looking for tips to stay mentally healthy? Check out this link.

Looking to get in touch with government advice? See here for U.K., see here for U.S., see here for WHO and see here for UN

Looking to learn how to build machine algorithms? Check out the Machine Learning Institute for more.

Looking to learn how to manage macro risk in finance? Check out the Bank Treasury Risk Management Certificate for more.

Looking to relax with 40 perfectly looped ambient GIFs? Check out this link.

Looking to watch cryptocurrency trades being processed live? check out this link.