The continuation of record-low interest rates is driving a never-ending cycle in the Swiss real estate market. This has multiple consequences: Negative interest rates are making home ownership unaffordable and – contrary to expectations – are limiting the supply of homes. They are also increasingly likely to encourage private investors to buy up apartments in order to rent them out. In addition, low interest rates are indirectly widening the price gap between central and peripheral areas, which is likely to further increase the number of commuters. Today, more than three million people commute to their place of work or education each day. Furthermore, negative interest rates are the cause of growing vacancies for rental apartments. According to Credit Suisse economists, pressure is strongest in the case of apartments that are no longer brand new.

Negative interest rates dominate the interest rate landscape at present. Central banks appear to have no intention of departing from their monetary policy, which is too expansionary for the Swiss real estate market. Investors should therefore expect several more years of negative interest rates. Meanwhile, the asset thresholds at which banks start charging savers negative interest are falling. Investors are therefore seeking opportunities to generate a positive return in real terms while being exposed to relatively low risks. The real estate market is the answer to their needs but this is creating sustained investment pressure within the investment property sector and further extending the existing supercycle.

Fear of negative interest rates is driving investors toward buy-to-let

Private investors seeking secure investments are following the example of more financially powerful investors by buying up residential properties with a view to renting them out (buy-to-let). Since multi-family dwellings are barely affordable in today’s environment, there is strong demand for condominiums and, in some cases, single-family homes. Low mortgage interest rates mean investors can achieve respectable returns. The proportion of buy-to-let financing has increased since the start of the financial crisis and now accounts for 17% of total new mortgage business. In other words, one in six condominiums are purchased by private investors for the purpose of renting them out.

These properties are typically found in good locations. More than half of all buy-to-let properties are located in cities or the surrounding area, where demand for rental apartments is robust. However, buy-to-let investments do not generate a positive return in all cases. The ratio of local residential property prices to locally achievable rents is key, with residential property in prime locations becoming so expensive that yields are very low indeed. This situation is compounded by interest rate and vacancy risks, which can create difficulties. Despite these risks, the fact that negative interest rates are increasingly being passed on to private clients will drive even more investors into buy-to-let in the future. Given that buy-to-let investors are also subject to strict lending rules – combined with the fact that nearly 90% of borrowers own only one such property – the economic risks have been fairly limited to date.

Negative interest rates strengthen demand for residential property but also drive up costs and limit supply

The cost of purchasing a condominium is more than five times the average annual income, and the cost is more than seven times the average annual income in the case of a single-family home. In Switzerland’s most expensive regions, a figure as high as ten times the average annual income will not be enough. There are still some regions where properties cost less than four times the average annual income but they rank among the most remote in the country. Meeting the imputed affordability criteria is becoming increasingly difficult, putting home ownership out of reach for the average household. Surprisingly, however, supply rather than demand is the limiting factor for the owner-occupier market. Basically, it is easier and more lucrative for property developers to build rental apartments, given that institutional investors are lining up to purchase such real estate in view of negative interest rates. The result is that too few properties are being built for owner-occupation, and the shortages are becoming visible. Against this backdrop, property prices are set to rise again in 2020.

A nation of commuters

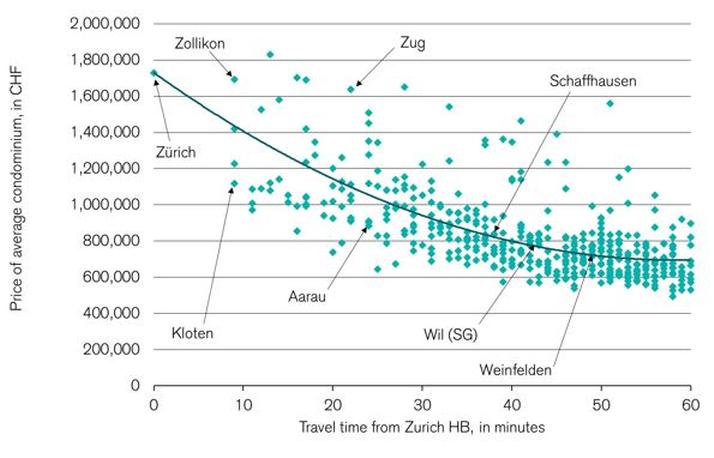

In their search for secure investments that generate a positive return in real terms, investors are turning to real estate in good – i.e. urban – locations. The price gap in relation to the surrounding area is therefore widening, with the result that the distance between a person’s home and place of work is increasing in more and more cases. Every day brings the spectacle of a mini-migration, with over three million people now leaving their residential municipality and commuting to their place of work or education. The average commuting time is over half an hour each way. Mobile commuters are therefore taking some of the heat out of housing markets in the major centers and boosting absorption rates within agglomerations. For property developers, the evaluation of commuter data provides useful indications of the potential demand from house hunters in suburban areas as well as from potential office tenants in small and large labor-market centers in Switzerland.

Vacancies mainly affect rental apartments that are no longer brand new

The residential rental market is unlikely to get a boost from immigration or economic growth this year. Consequently, Credit Suisse economists expect to see a sharper increase in vacancy rates for apartments than was the case in 2019. The already relatively long period it takes to market new rental apartments is therefore likely to increase even further. Interestingly, the highest vacancy rates are seen not among old or brand new apartments but rather among those that are modern but no longer brand new. This problem segment consists of rental apartments positioned at the more expensive end of the market that are between three and six years old, where the initial tenants have moved out. Apartments with fairly small rooms are less exposed to this risk, as Credit Suisse economists illustrate in the study. These smaller apartments show significantly lower vacancy rates in the case of buildings that are up to six years old. Rental prices are likely to come under slightly stronger pressure as vacancy rates rise more rapidly once again. Only in the five major centers and a small number of medium-sized centers are rental prices expected to increase slightly.

No high noon on the high street

Switzerland’s main shopping streets are also feeling the effects of the structural change in the retail sector. In contrast to the market as a whole, however, the top shopping streets in major city centers benefit from distinctive features. Their unique location qualities ensure they enjoy a high footfall and a high level of visibility. The latter is of key importance for retailers and manufacturers of branded products. Stores in top shopping streets are able to meet the changing requirements for brick-and-mortar retail, and they can expect rising demand from tenants again in the medium term. The shopping of tomorrow will mainly center around a few prime shopping streets – albeit in smaller stores than today, and with a diverse mix of tenants.

Figure: Price gap widens as the commuting distance from Zurich increases

Price for a new 4.5-room condominium in CHF, depending on travel time from Zurich main train station by public transport

See original source: Credit Suisse‘s Never-ending cycle for the Swiss real estate market

[do_widget id=custom_html-16]

Looking to manage bank treasuries and deal with concepts such as negative interest rates? Take the Bank Treasury Management Certificate to find your place in QE.