As the digital disruptive wave of ‘fintech’ progresses, an ever increasing number of financial instruments are becoming available at the download of an app.

We compiled a list of seven separate types of platforms that consumers can utilize, at very low entry costs. Whether you are a conservative saver, seeking new passive income revenue streams or just want an overview of what is on the table – there is something for everyone. This piece will look at;

- Savings Round-Up Apps

- Cards for Travel

- Alternative Asset Payment Methods

- Peer-to-Peer Loans

- Crypto Interest Accounts

- Robo-Advisory

- Zero-Commission Online Brokers

Savings Round-Up Apps: It can always be difficult to remember to put more away for a rainy day, and although the auto contribute/standing order buttons in a brick and mortar bank goes some way towards helping, these new kids on the block really take the biscuit.

The concept of ‘savings round-up apps’ came from Acorns in 2014 – widely recognized to be the original ‘first’. The mobile app rounds up each debit or credit card purchase to the nearest dollar, investing extra pennies in a diversified portfolio of low-cost index ETFs.

Chime, Qapital are others that have focused on this area and in creative ways have built platforms that enable and prompt users to save towards goals. Not wanting to miss out on a key user feature, neobanks such as Revolut have also utilized this to add to their customer experience with different levels of ‘savings aggression’.

Cards for Travel: For a very, very long time travellers were forced to pay extortionate rates to currency exchanges on the street at arrival. So what cemented Revolut in the minds of consumers probably more than anything else was their excellent currency conversion, at the interbank rate.

A regular customer is now able to pay the same rate when they exchange money as if conducting the transaction as a bank. The savings are mind-blowing.

But Revolut is not the only show in town, nor the best. AltFi believes that title should go to Starling Bank for their “comprehensive travel money service.” A great many more neobanks also offer something very similar, such as Monzo and Monese.

Then there is Curve, an aggregator of all your cards in one. Although this is a breakthrough brand, and concept, they go quickly to heart on their website – “Want to see the New York skyline without the sky high fees? Curve gives you killer FX rates.”

Alternative Asset Payment Methods: Although they might like us to position their group of fintech offerings as ‘paytechs’, owing to the fact that the underlying assets one is paying with fluctuates and therefore speculative, in our opinion it falls well within the realm of wealthtech.

We speak about organizations such as Glint, which allow users of their card to buy gold in-app and spend it anywhere they like, as if it were a normal debit transaction with fiat currency, or crypto exchange giant Coinbase, which allow card holders to spend cryptocurrency in micro transactions.

This concept is at the forefront of fintech and the Chief Operating Officer of Change Finance, Alice Tärk, sums up her vision of alternative asset payment methods – “For example, if someone wants to buy a coffee, they will use their mobile banking app and choose from a selection of different assets and currencies – from US stocks or gold to Bitcoin or olive oil. A smart algorithm will recommend the best-performing asset to use at that exact moment, saving the customer money. Such a system will give people control and freedom over their money they have never had before, allowing them to choose the value system that they want to support.”

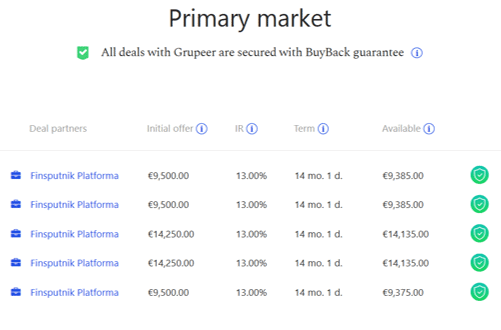

Peer-to-Peer Loans: There are two broad types of P2P platforms; those for personal lending (to another individual) and those of company lending. We recommend the latter. These platforms allow investors to choose projects to fund that enable them to jump into property developments from as low as €10, and earn steady annualized returns as high as 15%.

Notable fintechs providing this kind of marketplace are Mintos, Grupeer and Pionr. Note that not all of the loans on the platforms provide ‘buyback guarantees’ – enabling investors to redeem the principle should the borrower default.

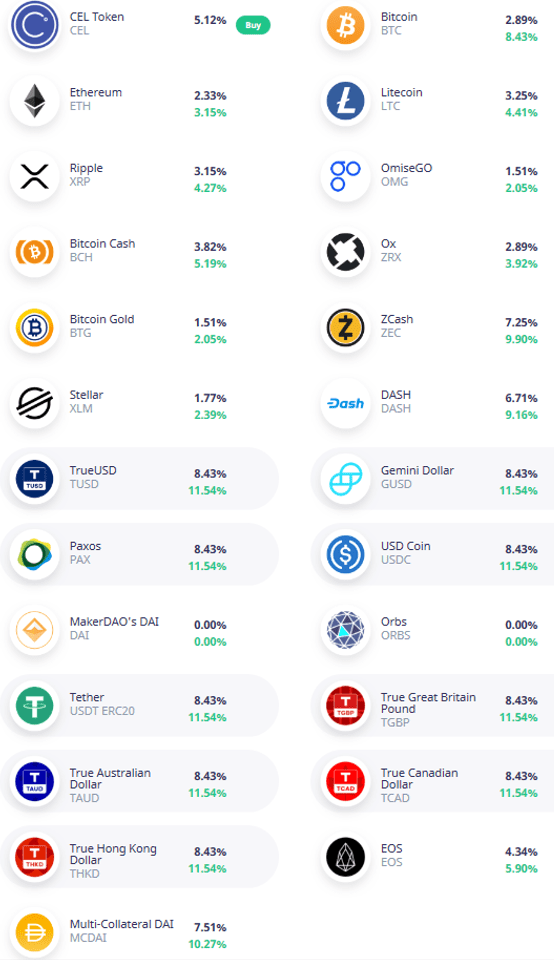

Crypto Interest Accounts: These are from fintechs such as BlockFi, YouHodler, Celsius Network and Nexo, that take crypto as a hedge against inflation to a whole other level. They hold cryptocurrency assets as a custodian and lend them out (similar to P2P loans but in crypto form).

The interest rates received vary from coin to coin, with Bitcoin typically coming in at around 2.5% APR.

But what is particularly brilliant about these platforms is the interest rates offered on stablecoins (cryptocurrencies pegged 1:1 to a fiat currency). For stablecoins, rates on what is effectively the $ or £ can be as high as 10% per year – a high-yielding savings account.

Celsius Annualized Interest Rates per token (with the green figure the income accrued if earned through their native CEL Token) as of today;

Robo-Advisory: These are wealthtechs that provide automated, algorithm-driven financial planning services with little to no human supervision. A typical robo-advisor collects information from clients about their financial situation and future goals through an online survey, then uses that data to offer advice and automatically invest client assets.

The two that consistently top the charts are WealthFront and Betterment but two that have recently been in the news by being acquired by Financial Institutions were TD Ameritrade and E*TRADE, by Morgan Stanley and Charles Schwab, respectively.

It should be noted that although these ‘automated advisors’ advice tends to be to invest in various Exchange-Traded-Funds (ETFs) that appear to be safe from depreciation, the vast majority of ETFs still follow the stock market and are therefore dangerous to invest in when the market is at peak levels (such as today).

Zero-Commission Online Brokers: Brokerages, the concept of price making between buyers and sellers, probably predates banking. But what does not, is the relatively recent phenomenon of ‘zero-commission trading’.

Just a few years ago, to participate in the stock market as an outsider, one had to pay a fee every time one bought and sold a stock, but now online brokerages such as Robinhood in the US, Trading212 in the UK and eToro in Europe, do not charge any fees whatsoever, bar the spread.

Interested in learning how to curate neural networks to extract insights from data? Sign up for the Machine Learning Institute Certificate today.

One Response